Early Retirement: The Simple Math Behind It

This blog will show you how to become wealthy enough to retire within ten years.

We talk about a lot of things at Mr. Money Mustache. These include investment fundamentals, lifestyle modifications that can save you money, business ideas that will help you earn money, and a philosophy that makes these changes positive instead of sacrifices.

Internet users can also find retirement calculators as well as competing opinions of a million financial advisors. They may be predicting financial disasters or expressing their own, but they are all voicing opposing views. There is also unpredictable inflation and a wide range of readers’ incomes and spending habits.

In “The Race To Retirement – Revisited”, I reviewed my path to retirement at age 30 in “A Brief History of ‘Stash”. I then did a hypothetical calculations using two average teachers salaries to show them how long it would be before they could retire.

People tend to get overwhelmed by this flood of information and say things like

You’re in for a pleasant surprise. When it comes down to it your retirement time depends on only factor.

Your saving rate as a percent of your gross pay

You can break down your savings rate into two factors:

What is your annual take-home pay?

How Much Can You Live On

The numbers are intuitive and easy for you to understand, but the relationship between them is quite surprising.

You will never retire if you spend 100% or more of your income. This is unless you have someone else saving for you, such as wealthy parents, social security funds, pension funds, etc. Your work career is infinite.

You can retire now if you spend 0% of your earnings (you are living for free in some way). Your working career could be zero.

There are some interesting things to consider in between. Once you begin to save and invest your money, the money starts to earn money on its own. Then, the money earned from those earnings starts earning its own money. This can quickly turn into a snowball of income that is exponential.

You can retire as soon as you have enough income to cover your expenses and still invest enough each year to keep pace with inflation.

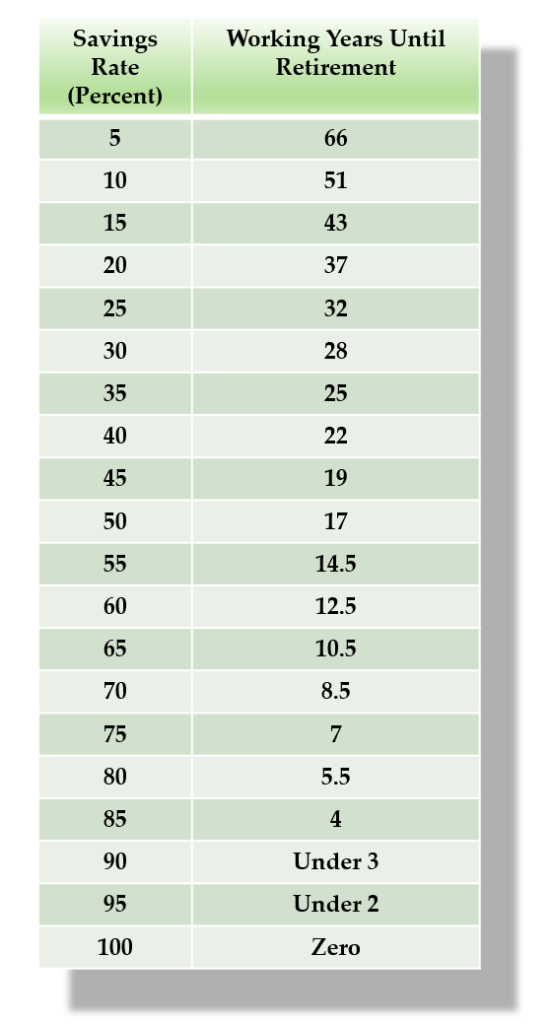

This graph would look like this if you were to draw this “savings rate story” into a graph.

Savings rate vs. Working years (screenshot taken from networthify.com).

This chart, along with a more detailed worksheet* that I made to recreate the equation which generated the graph, shows you how to be “financially-independent” in 16 years.

Let’s simplify the graph. You can focus on saving as much of your income as possible. I will make conservative assumptions. You can get a rough estimate of the number of years you will need to be financially independent by looking at the table below.

Assumptions:

- Your savings years can yield 5% returns after inflation

- After retirement, you’ll be able to live on the ” 4 percent safe withdrawal rate”, with some spending flexibility during recessions.

- If you want to make your ‘Stash last for as long as possible you will only touch the gains. This income could be supporting you for up to 70 years. This assumption is a generous safety margin.

You will need to save a certain amount of money in a given number of years, starting with a zero net worth.

It’s amazing, particularly at the lower end of the Mustachian spectrum. In today’s world, a middle-class family earning 50k with 10% savings ($5k) would be better off than the average. Unfortunately, “better-than-average” is still pretty poor, as they will have to work for at least 51 years.

They could retire eight years sooner if they cut cable TV, and bought a few more lattes. Is it worth working an additional eight years to save money on cable TV or Starbucks? ?

The first thing you should note is that reducing your spending rate has a much greater impact than increasing your income. Every permanent reduction in your expenditure has a two-fold effect.

- It increases the amount you can save every month

- It decreases your monthly expenses

Your lifetime passive income increases due to a larger nest egg of investments , and because it meets your needs more easily, since you have developed a greater skill in living efficiently, and therefore you need less.

You can retire in 10 years by living on just 35% of what you earn. I did this without realizing that it was possible. Mustachians are a rare breed because this article won’t appear in USA Today. If it appears, the people will be too busy complaining that it cannot be done to figure out how to make it.

+ There are no comments

Add yours