4 Ways to Build Passive Income

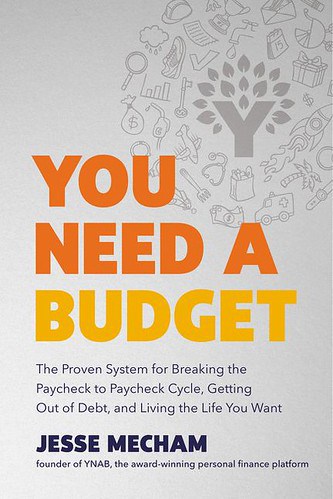

Finding new ways to make money is key. Building a passive income is a great way to increase your household income. Learning how to build passive income in life can create a more prosperous future for your family. The practices in this article will help you understand passive income and learn some of the best ways to do it while making the most of your time and resources.

Why is passive income valuable? Did you know that passive income can help you transform your financial future? If you’re struggling to save for a down payment on a home, a new car, or paying off student loans, that’s great. You can also use this extra money to further invest and build more wealth. For example, if you have an online store, you can still earn an income even while sleeping or on vacation. This is where the value of passive income lies. A paraphrase of this paragraph with specific examples and details:

You’re investing in a rental property, and you can use the money you earn from it to buy a second property. This passive income can be emergency, in case of a need. For example, if you or a family member needs medical attention, having enough money on hand can greatly reduce that burden. So how do you create passive income?

Method 1: Buy an investment property购买投资性房产

Putting money into another property can be one of the most profitable ways to generate passive income. While the initial investment may be high, buying an old home to renovate and resell, or buying a home for rent on platforms like Airbnb and VRBO, are great investments. For example, you can find a promising neighborhood, buy a vacant house, and then renovate it to make it a comfortable place to live that attracts tenants. This way, you can collect the rent every month without having to invest too much time and effort.

This is just one way, there are many other forms of passive income. Creating passive income takes time and effort, but once established, it can be an important source of your financial stability and freedom. The rewrite is as follows:

While investing in a home is a complex and costly task, it also comes with many benefits. Learning how to get a home loan up front can help you narrow down your options in terms of location, home size, and home amenities so you can use the funds for the upgrades you want to make. The more upgrades you make in your home, the more you can charge the lessor, increasing your passive income.

Flipping houses is another way to invest in real estate. Whether you buy a house and then flip it or rent it out for the long term, the money you earn can become your future investment savings account. Often, if you can buy one of these houses at the right price, then you have the potential to make a handsome profit from it.

As an example, let’s say you bought a house for $1 million and then spent $200,000 on upgrades and renovations. If you rent the house for $15,000 a month, the monthly rental income will offset some of the mortgage and other expenses. At the same time, you can also consider selling the house at the right time to get more profit.

Of course, investing in real estate requires careful consideration, including market trends, geographical location, housing conditions and many other factors. However, if you can find a way that works for you, then real estate investing can be a great way to increase your income and wealth. It is true that investing in property upgrades requires a lot of work, including investing time and resources. However, it could lead to quick profits. However, it is important to note that not all renovation work will bring the expected profit.

To take a concrete example, if you own a dilapidated shop in a busy commercial area, you might consider renovating it into a modern boutique. By improving the image and attractiveness of your store, you can attract more customers and thus increase sales. This renovation can cost a lot of money, but it can be lucrative if successful.

Plus, renting out your car on a car-sharing app can be a nice way to earn extra income. Apps like Turo are easy to use and have a huge customer base. You can list your vehicle the same way you list your home on Airbnb. People can then reserve your car and rent it for a period of time.

However, this takes some experience. Turo makes it relatively easy to sign up and has many resources for landlords. In addition, they provide insurance for landlords, which can provide some protection in the event of an accident.

Overall, whether investing in a property upgrade or renting out your vehicle requires careful consideration and planning. However, with the right amount of effort and resources invested, you can reap great rewards in these ways. As a veteran writer, I can rephrase this passage from a different Angle and perspective. Here are my ideas and details for you:

If you want to make money by renting out your car or choosing a different protection plan, then Turo is a great choice. The app allows you to manage your vehicle from anywhere, such as pausing and re-listing the vehicle. To be successful, one suggestion is to specifically buy vehicles that are suitable for rental online, and look at the types of vehicles in your area in the app to choose a vehicle that is more likely to be rented regularly.

However, every investment has risks, and this is no exception. For example, your car may break down or fall out of favor, so it’s important to know and research Turo rentals before making an investment.

Another way to make money is to invest in the stock market. You can acquire shares of a company by buying stock and receive dividends from the company’s earnings. If you choose to invest in large blue-chip companies, you can get a steady stream of income. For example, companies such as Coca-Cola, Apple, and Google are blue chip companies whose stocks are very popular and stable.

When investing in the stock market, it is important to be cautious and do adequate research. It is very important to understand the financial situation of the company, the industry outlook and the competition situation. In addition, it is also very important to understand market trends and macroeconomic factors.

In conclusion, as a veteran writer, I recommend that you try different ways of making money and look at them from different angles and perspectives. With careful investment and research, you can find a way to make money that works for you. To build passive income, investing in the stock market is a common and effective approach. Imagine, for instance, that you decide to set aside a portion of your monthly paycheck to invest in the stock market. Over time, you’ll be able to track the progress of your investments and make informed decisions about where to invest next.

The beauty of investing in the stock market is that it doesn’t require constant attention. Once you’ve done the necessary research, you can invest with confidence, even if you’re a beginner. It’s like having a personal finance manager, except the money you invest can continue to grow even when you’re not actively managing it.

One of the great things about investing in the stock market is that you have flexibility. Imagine that one month, you have a little extra cash laying around. You can add that cash to your investment portfolio, allowing it to grow even more. Similarly, if you have a month where you incur some additional expenses, you can take money out of your portfolio without any issues.

Let’s say, for instance, that you invest $100 per month in a dividend-paying stock. Over time, that investment starts to grow, paying out dividends monthly. Even if you decide to take out $50 one month because you have some extra expenses, your investment is still growing and paying dividends on the remaining $50.

In conclusion, investing in the stock market is a great way to build passive income. It allows you to put in money when you have it and take it out when you need it. Plus, by doing proper research and understanding the market, you can rest assured that your investments are growing even when you’re not actively managing them. If you want to reduce your investment that month, you can come to the door and play a practice game with another team. So there are some balls

Fans came home one after another and sighed, “It’s just two teams… After reading this kind of heart cool into

You can’t spend half your life savings to get the results you want. If I had $5,000, sold the old house, replaced it

The house in Shanghai is now worth at least 10 million yuan.

The beauty of this type of investment is that the money will accumulate over time, and you will not invest as planned

No additional work is needed. In addition, if you plan to use passive income for retirement, this way of investing

It’s one of the best choices. Because the money you invest in the stock market is kept separate from other savings, it can’t be easily diverted.

#4. Turn your favorite hobby into a side business

It’s a great choice for creative hobbies like art, sewing, or DIY projects. There are many ways

Make a quick profit by repurposing items you no longer use. This behavior is called “upcycling.” For example, you can

Turn old furniture into art, or transform old clothing into stylish accessories. If you can find a way to take your hobby

Become a way to make money, then you can have fun and increase income at the same time. People often repair and renovate old items, such as clothing and furniture. For example, a shirt that was once damaged can be mended and cleaned into a new look. Similarly, an old table can be restored and repainted into a new and stylish table. Restoring and refurbishing these items not only gives them a new look, it also saves resources and money and is an environmentally friendly way to live.

+ There are no comments

Add yours