Why I Keep a Money Journal

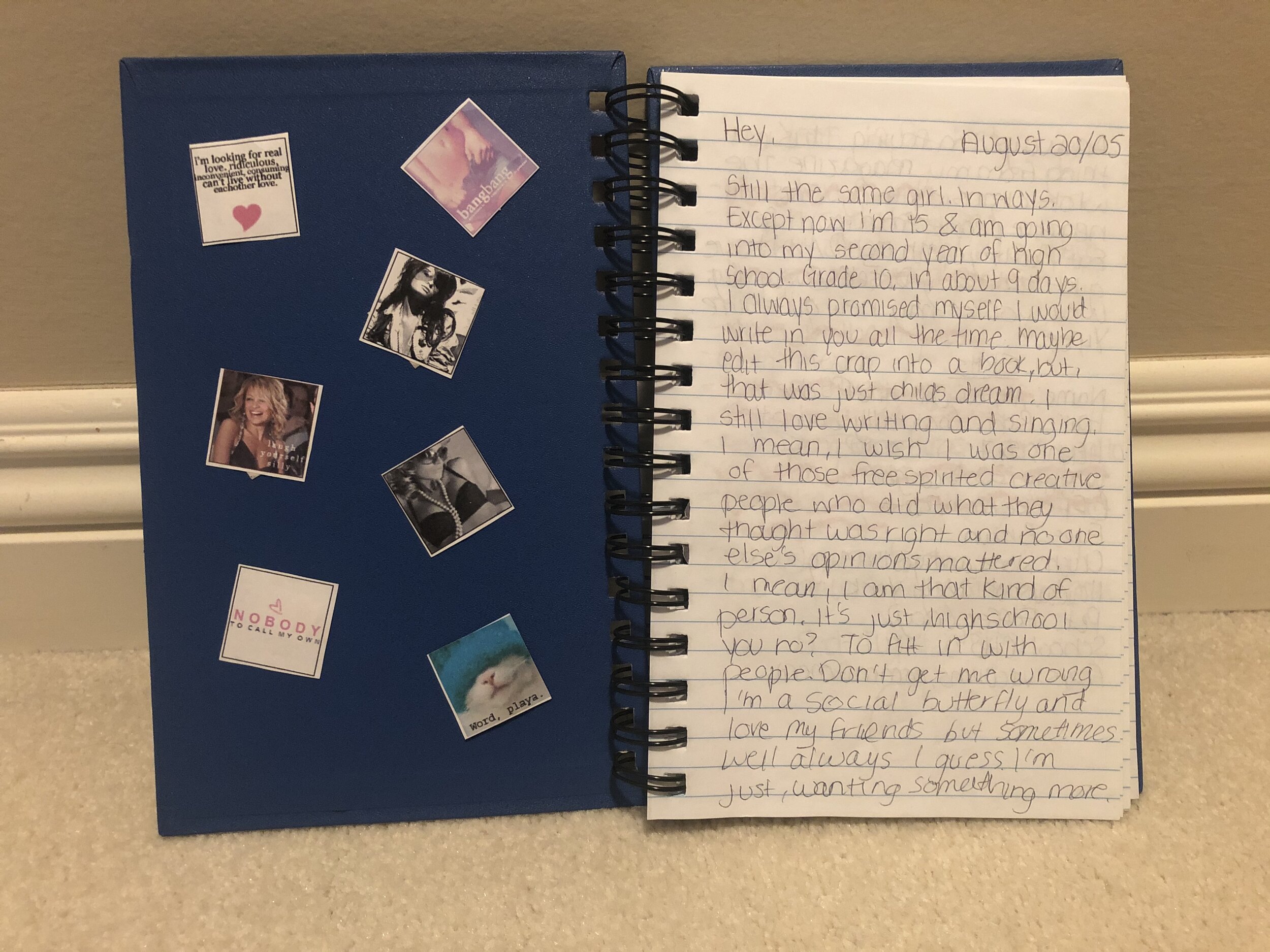

Since middle school I have kept a diary. The journal used to give a glimpse into my daily life. It included lists of my favorite activities, my crushes, and my ranking from bottom to top for my friends. (I was 12). Below is an important entry.

You probably also think of your “Dear Diary”, or similar, moment when you consider a journal. It’s not just about keeping a diary. After searching for ways to manage my negative thoughts about three years ago, I purchased a blank journal so I could practice gratitude every day. Every day, I wrote three things I was grateful. It helped me to clear my mind, reflect on what was important, and gain perspective about the person and life I wanted to lead.

Even if you think you are not good at writing, it is still important. We all need to reflect if we are to succeed in our financial lives. It is at least for me and I would like to share my reasons.

NUMBER 1. GOAL SETTING

It is important to write down your goals. This will help you achieve them. You can add details like checkpoints and bullets to your journal, which will all help you reach your goals.

Last summer, I spent the majority of my time indoors ( who needs sunshine ) writing and creating The Hundred Day Financial Goals Journal: Create a Plan for your Financial Future. I shared my own personal methods for setting goals and how to move from managing money out of necessity to doing so with understanding and intention. It’s less than a month until launch, and I am so excited to see you practice journaling the way that works for your financial life.

Order your copy now

NUMBER 2. MEMORIES

It’s a wonderful place to keep treasured memories and keepsakes. You don’t have to be a scrapbooker to save your favorite moments. But maybe you would like to. Photos and videos are a big part of my daily life. I want to feel the visual connection and remember what I felt at that moment. Written memories and journal entries fill in the gaps that pictures and videos do not. Journaling about my holidays helps me remember how I felt when I first experienced something and what I was feeling. The photos only capture a memory. They don’t tell the whole story.

My journal contains both positive and negative memories in terms of money. You need to keep track of all your memories, whether it’s a bad financial decision or a big milestone you worked towards for many months or even years.

NUMBER 3. PERSONAL GROWTH

Writing down three positive events that occur to you during a given day or week is a realistic habit. This will make it easier to reflect when you look back and see what’s draining your energy from day to day.

My husband and I recently completed the yearCompass at the suggestion of a good friend. It’s possible that I wouldn’t be able tell you my goals if this was a typical New Year resolution. But writing them down makes them real. By tracking your positive growth, you can avoid negative self-talk that we often use to blame ourselves for not accomplishing something we have set out to achieve.

NUMBER 4. IMPROVING MEMORY

It’s impossible to expect that you will remember all the information you are presented with each day. The digital world has exploded. It’s normal to feel like an evolved goldfish. Hey, an average animal’s memory span is only 27 seconds. Maybe we aren’t doing too bad after all? It’s scientifically proved, but in all seriousness: keeping a diary and expressing yourself regularly on paper can improve working memory.

You may forget your plans for the day or weekend when your mind is cloudy and you’re just going through motions. You can give yourself a chance to remember your goals for the day by taking a few moments in the morning and at night.

NUMBER 6: A Journal is a Safe Space

We all have different feelings about money. Your journal is the perfect place to express your emotions and make decisions. You can’t tell anyone how you feel, or why to spend your money in a certain way.

A journal is the perfect solution if you want to keep track of your personal finances but don’t like using an app or online. I don’t use budgeting apps. Instead, I record my monthly expenses manually at the beginning and end of each month. This gives me time to reflect and think about those purchases and bills.

NUMBER 6, ACCOUNTABILITY

The last and most important piece of the financial-journalling puzzle is how to hold yourself accountable. It’s easy to go round and around about money. There are many excuses, but when you’re alone with your credit card, you can only talk yourself out of making a bad decision.

Accountability and journaling go hand-in-hand. Once you commit and write down your goals, there’s no turning back. Every time you check in daily or weekly, you will see your written goals and be driven to achieve them.

My only recommendation is to give it a try if you have never done it before.

You can pick up a copy of my journal at your local bookshop and begin to write every day in small, but meaningful ways.

You can control your finances. It’s up to you to decide what works best for you.

+ There are no comments

Add yours