Budgeting: An Easy Guide To Creating A Budget That Is Effective

John C. Maxwell: “A budget tells you where your money is going, instead of having to wonder where it has gone.”

In the last year, I have had more money coaching sessions with individuals than in my twelve previous years of writing about money. I used to say that I would never do any money coaching. I was apparently wrong.

When I talk to people, certain themes are common.

One of the biggest problems is that most people don’t know how much money they are actually spending or earning. They are like a dark box. The money is deposited in the bank and then spent until the funds are gone. Few people actively track their income and expenditure. Do I have money on my checking account?” “I can buy something!”

People can’t plan their spending because they don’t keep track of what they’re doing. I often suggest to people that they make a budget. Budgets are a controversial topic because they have been vilified for so many years. It’s a shame. Budgets do not have to be an inconvenience. They’re a great way to control your finances when used properly.

You can achieve your goals faster if you choose a budget that suits the way you live. What’s the key? Do not think of your budget as a restriction. A budget can help you to break free from the constraints of real life.

Why Budgets Fail

Budgeting frustrates many people because it never works. The budgeting process never seems to work. Budgets can be ruined by unexpected expenses. It may seem like a lot of work for little reward. I understand you. I understand. Budgeting can become less stressful if you adhere to a few simple rules.

According to my experience and the comments of GRS users like you, I think there are several reasons why most budgets fail. Your budget may be in trouble if you:

- Budgets are often overly complex. It is often more beneficial to have a simple budget.

- Make it personal. Your budget shouldn’t be based on someone else’s values. Instead, your budget should reflect your own. You’ll have a hard time if you try to follow someone else’s budget.

- This budget does not reflect reality. Build your budget based on the actual income you earn and how you behave, rather than on an idealized version of yourself.

- Your system can be a drag. You want a budget that is effective, so continue to search until you find the right one for you.

To summarize, A budget should be simple to minimize failure risk and easily used while reflecting current realities and future goals.

This is all a bit esoteric. How would a simple budget look? There are many approaches that work. Although some can make detailed budgets function, I have found that “budget frames” work better for me and my clients.

We’ll dive deep into the world budgeting today. Here are my tips for budgeting based on 13 years of writing and reading about money.

How to Create a Budget

Many times, when someone decides to put their finances in order they struggle to create a budget. It is common for people to create a budget so complex that it confuses them. Simple budgets tend to be successful.

Andrew Tobias, in the Only Investment Guide you’ll Ever Need offers a simple but effective budget:

- Discard all of your credit cards

- Invest 20 percent of your earnings. Do not touch it.

- You can live on the remaining 80% no matter what.

Tobias may be glib but this system is excellent. You can be rich if you have the discipline to only follow these three steps.

This budget is too flexible for most people. It only has two categories, saving and everything else.

The 60% Solution

Richard Jenkins, the editor-in chief of MSN Money a decade ago, proposed a budget he called The 60% Solution. This link will take you to an overview of Jenkins’ framework on the Web Archive. MSN has decided to delete the original article because it thinks that old content is cool.

Jenkins, who had been budgeting for twenty years, decided that detailed budgets were too much work and provided too little information. He created a simplified framework. His goal with this framework was to keep Committed Costs manageable. Jenkins says Committed Expenses is Wants or Needs you cannot or will not compromise on. They’re yours.

The 60% Solution recommends allocating your monthly gross income ( before-taxes) as follows:

- 60% of Committed Expenses like taxes, clothing and basic living costs, insurance, charitable giving (including tithing), regular bills, including your cell phone, and other expenses.

- 10% Retirement

- Add 10% to Unregular Expenses, such as holidays, major repairs, new appliances, vacations, etc.

- Set aside 10% of your long-term savings/debt for home improvements, car purchases or debt repayment.

- Fun Money can be used to indulge in hobbies, dining out or other activities.

Jenkins believes that reducing Committed Expenses is the best way for money pressure to be relieved. Stress increases when your Committed Expenses increase. You’ll be able to save more money if you keep your Committed Expenses below 60% of your income.

The 60% Solution is simple, but powerful. Ramit Sethi, the author of I Will Teach you to be Rich, uses this for his “Conscious Spending Plan”. Ramit Sethi, who is known for his dislike of budgets, has used it as a basis for a budget. You can be sure that a budget is good if Ramit Sethi likes it.

Balanced Money Formula

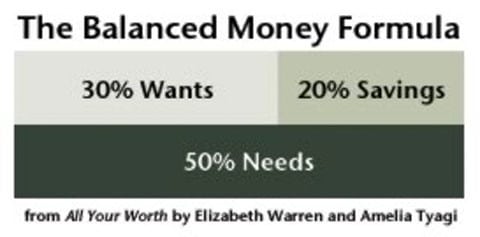

My favorite budgeting framework is the Balancing Money Formula found in The Ultimate Lifetime Financial Plan, by Elizabeth Warren and Amelia Tyagi. Yes, Elizabeth Warren . I am endorsing the budget framework of Elizabeth Warren, not her Presidential campaign.

The Balanced Money Formula, which is sometimes referred to as the “50/30/20 Budget” by bloggers who are too lazy to research it, is designed to help people pay off their debts and save money while still allowing them to enjoy financial luxuries like cable TV and going out to eat.

Warren and Tyagi claim that to be successful financially, it is important to keep your finances in balance. The net income (after tax) is divided as follows:

- The authors recommend allocating no more than 50 percent of your budget to the Must-Haves (also known as Needs ). Housing, groceries, transportation, insurance and clothes are all needs.

- Save at least 20 percent of your income for savings. This includes debt repayment as well as retirement contributions.

- Spend the remainder (roughly) 30 percent on Wants. Wants can include cable TV, clothing above the basic level, concert tickets, comics, knitting supplies and more.

Warren and Tyagi say that to maintain financial equilibrium and be happy you can’t spend more than half of your income on Needs . Spending less is better. Warren has seen how Americans are digging themselves a hole by taking out huge car and mortgage loans. You must reduce your spending on housing if you are to maintain a budget that is balanced (and build a snowball of wealth).

The Balanced Money Formula includes debt reduction in the category of Savings. This is great. It’s so good that I have included it in my “financial platforms”.

Note All three budget frameworks have a weakness: they only target twenty percent of their budgets for debt reduction and savings. Twenty percent is a great amount. This is more than what financial advisors recommend and more than the average person saves. Twenty percent is a good starting point. In the end, I believe that most people are better served by saving half their income.

Automating your Budget

Budget frameworks help you see the big picture, but they are not very useful by themselves. You need a system to build a budget. You must know how to use a framework.

In the 1970s, I remember my parents’ attempts (and failures) at budgeting. Mom and Dad were frustrated by their financial situation, so they would sit at the kitchen counter to create a budget. After much heated discussion, they would draw up a detailed budget in a spiral-bound notebook. Mom would then track their expenditures and compare them to their projected amounts over the following weeks.

Budgets have never worked. It was too much work. There were many other reasons why the budgets did not work, but the sheer amount of labor was a big factor. After a few weeks of frustration, Mom & Dad gave up. It’s no wonder they always had money problems.

Today, life is easier.

Bloggers have reported that many people use Personal Capital for tracking their spending. Although expense tracking is not the same thing as budgeting it is an important part of the process. You can’t know whether you are sticking to your budget if you don’t keep track of how much money you spend.

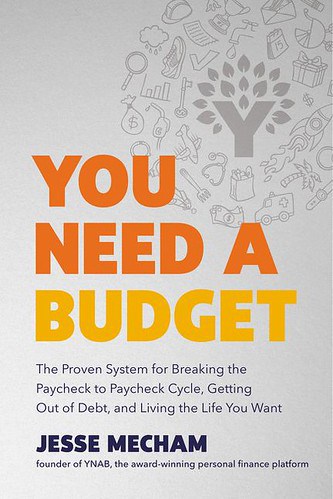

After talking to Get Rich Slowly’s readers, I think that You Need a Budget is a better option than Personal Capital for automating your budget. It’s not surprising that this is the case. YNAB was designed to help you budget! Here’s a review I did of YNAB.

These apps are not without their downsides. Personal Capital is an excellent free tool but it also serves as a lead generation tool for wealth management firms. The software makers hope that you will become a customer if you continue to use it. YNAB is not a bad company — it’s actually awesome! — but there is a monthly fee. This fee is well worth it for most people who have to budget.

You still have options. You can buy desktop software that allows you to budget and track expenses. It’s not a secret that I manage my finances with Quicken 2007. I’ll eventually upgrade to a new version of Quicken. The old version is working fine for now.

Jim, my buddy at Wallet Hacks, is a big proponent of creating personalized budget spreadsheets. He wrote recently that budgeting spreadsheets always beat automated tools. Jim, however, is a huge nerd and loves to play with numbers. If you are less of a nerd than Jim, Personal Capital or YNAB may be a good fit.

It doesn’t really matter what tool you use. There is no one right answer. You can try several to see which one works best for your needs and budget. It’s important that you use it and that it helps you achieve your goals.

Envelope Budgeting

Most people will find automated budgeting tools useful. Others, however, may need a different approach.

I recently met my friends Wally and Jodie , and I had the impression that, while they are making progress on their debt, they still struggle with organization. Part of the problem, I believe, is that their budgets are abstract. It is not something tangible, but only exists on paper or inside their heads.

“Have You Heard of Envelope Budgeting?” I asked.

Wally replied, “No.” “What is that?” I explained briefly.

You can use the envelope budgeting method to manage your budget. It can be used with the 60% solution, the Balanced Money formula, or more complex budgeting systems.

It’s simple: You divide your cash when you receive it into envelopes that correspond to specific budget categories. This is how it works.

- Select budget categories Use a separate envelope for each category that you want to track. Each envelope should be labeled with the name of the budget category. Wally and Jodie might, for example, have an envelope to be used for their wedding, another for travel, another for groceries and utilities, etc.

- Put money aside. Withdraw cash after your paycheck is deposited for each category you budgeted. If Wally or Jodie budgeted for $200 worth of groceries to last them two weeks, they would put $200 into their grocery envelope. They’d also note the amount on the back.

- Make purchases as normal. Take cash out of the envelopes at the beginning and end of each month. Note the amount of money on the envelope’s back when you remove the cash. Note how much money is left in the envelope. Put the change and receipt back into the envelope after you have purchased something.

- You have two choices if you run out money in your envelope. If your envelope for “Dining Out”, is empty, hard-core budgeters say you should keep it until your next paycheque. After you have spent your budget for restaurants, it’s over. Some people say it’s fine to use money from one envelope to pay for another. It’s up to you which route is best for you. Please don’t use credit to cover an empty envelope.

- Determine what to do with the surplus cash. You’re likely going to have some money in envelopes at the end of a pay period. This is something you should plan for. You could leave the surplus in your grocery envelope, giving you an extra budget for the next pay period. If you still have $87 in your grocery envelope, and you add another $200 to it, you will have $287 available for the next pay period. It might be a better idea to put the extra cash you have at the end a pay period towards a long-term objective. For example, Jodie and Wally could put their extra grocery money in an envelope for their wedding.

- Repeat the process every pay period. Make adjustments if you find that you have a consistent deficit (or surplus), in certain categories.

YouTube has a great step-by-step tutorial on how to create a budget envelope:

It’s a system-agnostic approach. It doesn’t matter what budgeting system you use. It can be used for all your budget categories, or only a few. I think that most people will use it to track variable expenses and not fixed ones like mortgages or phone bills. Plus, it’s physical. You’re forced to handle the money and feel “pain” of paying.

Some people prefer the envelope system, but do not want to deal with envelopes. A budget spreadsheet can be a great way for these people to simulate the envelope system. (Or you could try to recreate it using the You need a Budget software.

Kristin Woong, a member of Get Rich Slowly in 2013, shared with us her experiences about returning to the envelope system.

How to build a better budget

It’s a lot to learn about budgeting. This information can be confusing. Before we conclude, I would like to give you a few last tips. Let’s begin with what I believe are the four cardinal budgeting rules.

- First rule: Do not worry about perfectionism. Budgets are targets. You won’t have perfect spending the first month. Or the second. Or the second. You can get close to a perfect balance if you try. Don’t quit. Learn how to adjust your budget.

- Second rule: Big things make a bigger difference than small ones. You should definitely clip coupons and go to thrift stores. You can save thousands by buying a home or car with a little bit of foresight. Reduce your major expenses, such as housing and transportation. You’ll find that you have more money to spend on fun things.

- Budgeting’s third rule: Plan based on what you actually do, not what you would like to happen. Do not budget for potential salary raises and ideal expenditure habits. Make sure you include coffee in your budget if it is a daily habit. Don’t include your income if you haven’t been given a raise. Budget for reality and not wishful thinking.

- Fourth rule: Keep your budget simple. Don’t make it a chore to use. Include as little detail as possible. Tracking your spending should be easy for you.

If you have trouble keeping your budget, you may be trying to estimate your spending by using time intervals that are too small. In a study from 2008, published in the Journal of Consumer Research, it was found that those who created annual budgets had better control over their finances than those who used monthly budgets.

Original press release:

Researchers found that contrary to popular belief, the research findings were not in line with what people commonly believe. People were more accurate in constructing a budget for the year rather than monthly Even when they were tracking their expenses on a weekly basis.The authors write that “consumers have a tendency to underestimate their budgets for the next month as well as next year.” Budgets for next year, however, are more in line with actual expenses, as consumers adjust their budgets upwards because they feel less confident.

The fact that consumers include more expense categories in their yearly budgets is one reason they are more accurate. Will you remember to add a Christmas gift category in your April monthly budget?

You’ll know that I’ve experienced some of these things if you’ve been following my spending this year. “Oops! I forgot that I would have a large tax liability in April. Oh my, I forgot to book a vacation for September 2019 in April 2018. The balance is now due.”

Budgets for the year are not very helpful in planning your daily spending. It’s obvious to combine the best of both:

- Create an annual budget. People are more likely to estimate yearly costs than monthly ones.

- Divide your estimated costs in each category by 12. You will now have a number for each month.

This study confirms that overconfidence can be a huge drag on a person’s financial situation. We think we are immune to advertising and that we have the ability to handle credit responsibly. But study after study shows that this is simply not true. In fact, people who are lacking in confidence make the best decisions when it comes to their finances.

Budgeting is no different. This study found that subjects told budgeting is difficult were more accurate in their estimates of expenses than those told budgeting is easy.

Budgeting Frees You

Budget is a four letter word for many people. Money bosses are not allowed to use budgets. Money bosses see budgets as useful tools to help them build the lives they want. She knows, however, that a budget doesn’t have to be set in stone. The work is never done.

You need to constantly adjust your budget, even if it is as simple as The Balanced Money Formula. Once you have figured out your Committed Expenses (or Needs), it is usually not necessary to pay much attention to them. For example, your housing payment does not fluctuate month to month. Insurance premiums are pretty stable. Your savings are no different. Saving a certain amount becomes a habit once you start.

You should then aim to reduce your Needs while increasing your Savings, until both are at a respectable and sustainable level. You can spend the rest of your money on Wants if you keep these two categories at their proper levels.

Budgeting doesn’t have to be a burden. Budgeting gives you freedom.

Do you need more help creating a budget plan? These tools can help you create a budget.

- Here’s an easy and free Google Sheets Budget Planner from GRS Reader Jeff M. (And here’s the article in which he explains it. Jeff M. also shared a Microsoft Excel Version.

- The new File Vault contains free PDF downloads which might be useful. My handout on creating a better budget, and a Worksheet for the Balanced Money Formula.

- Wallet Hacks has compiled a selection of budgeting worksheets. Some of them are specialized.

- You Need a Budget has a number of amazing tools. The software (my review), the book (my reviews), and the YouTube channel are all available. YNAB can be a good resource for learning how to budget.

Try another budget if the first one doesn’t work. Do not blindly follow a budget created by someone else, even if it is from Dave Ramsey or SuzeOrman. You can use their budgets as a guide, but you should tailor them to fit your lifestyle.

It worked!

Please note: The article was originally published on 02 May 2011. In fact, it’s so new that I would call it an article. I have moved many of the comments from the old article forward and, as always, placed a mark so that you can see where the old comments end and the new comments begin.

+ There are no comments

Add yours